One year ago, New York City Mayor Bill de Blasio and Comptroller Scott Stringer announced the city would begin the process of examining divestment among New York City’s five pensions. Twelve months after the lackluster announcement, city leaders again cheered themselves as taking a “major step” forward: selecting the advisers it will utilize to evaluate options for the city’s retirement funds.

Needless to say, one year later and the city’s “landmark” divestment decision remains as empty as the gesture itself.

For starters, Mayor de Blasio and Comptroller Stringer are just one part of the group that would need to approve a final divestment plan from moving forward. From POLITICO in September 2018:

“DiNapoli also pointed out that the state pension fund has made the same progress on divestment as New York City — meaning, no progress at all. While Mayor Bill de Blasio and city Comptroller Scott Stringer have been praised for supporting full divestment, the five boards that actually control the city’s $195 million pension system have yet to actually approve divestment. Stringer and a mayoral representative sit on each board, but control a majority of none. The trustees must still vote on a divestment proposal, which isn’t scheduled to be released until later this fall.”

In August POLITICO also highlighted the many inconsistencies with New York City’s divestment story to date, including the fact that two of its five pensions have refused to take any steps towards divestment – and the three remaining are far from approving a plan.

“The city has not divested any pension money from the fossil fuel industry. So far, it has only announced its intention to study the issue — an analysis that has not yet begun. Moreover, de Blasio doesn’t control whether or not the city will ultimately pull the money out of fossil fuel holdings. The city’s roughly $199 billion pension system is made up of five separate funds, each governed by its own board of trustees. The trustees would need to approve any proposal to divest — and while a mayoral representative gets a vote on each board, de Blasio doesn’t control the majority on any of them…In January 2018, de Blasio and city Comptroller Scott Stringer announced their support of fossil fuel divestment and set a goal of divesting $5 billion from fossil fuel holdings before the end of 2022. Shortly thereafter, they submitted a resolution to the pension trustees to study “prudent steps” to divest and evaluate anticipated risks to the portfolio. Only three of the five boards — NYCERS, Teachers’ Retirement System and the Board of Education Retirement System — voted to approve the resolution to study the issue.”

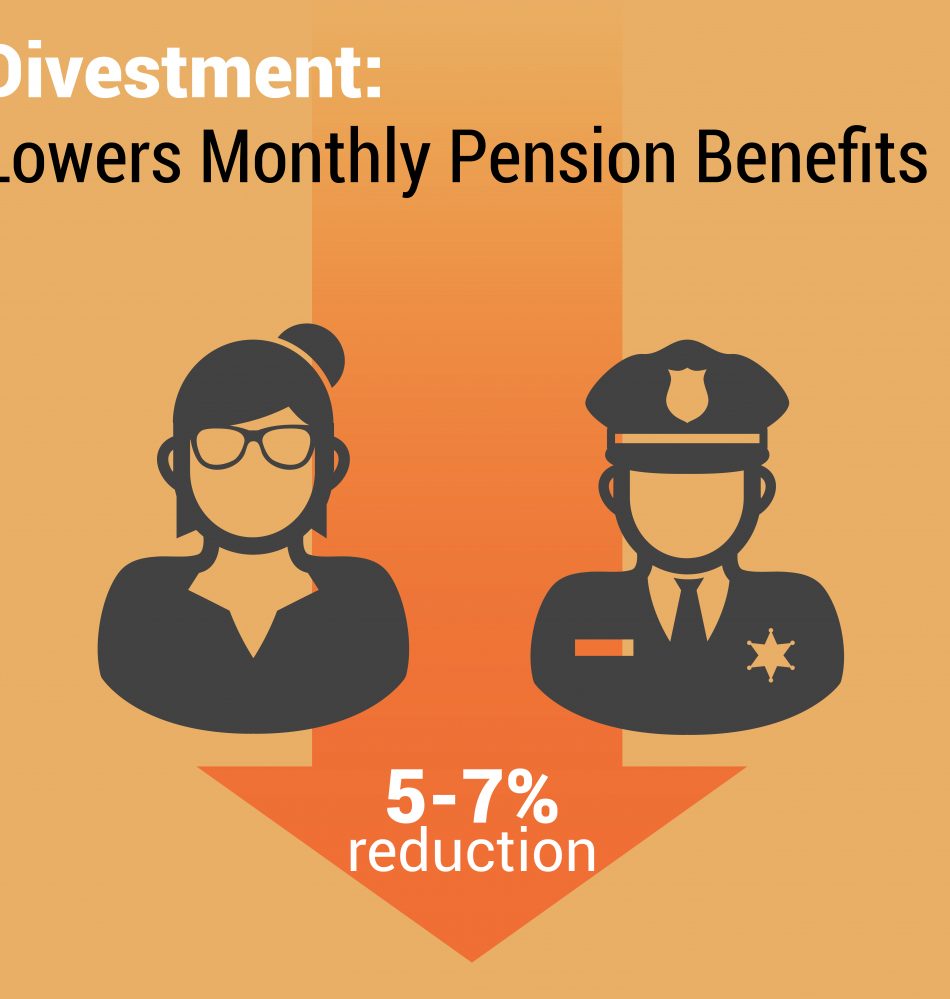

Any move to divest will legally have to fall in line with the city’s fiduciary duty – a fact we know to be impossible as seen here, here, and here again. For example, a report by Prof. Daniel Fischel of the University of Chicago Law School found if New York City were to fully divest, it would cost the fund up to $1.5 trillion over a 50-year time frame and up to $120 million annually. Those losses are only those associated with lost diversification benefits. New York City stands to lose billions more thanks to increased compliance costs and management fees associated with actively managing a portfolio that size.

Alongside a small step forward in divestment, the city plans to double investments in “climate solutions.” More tangible than divestment perhaps, but also ignorant of the solutions and strides underway by traditional energy producers to reduce emissions, improve technology, and provide resources like clean-burning natural gas for consumers — a product directly tied to improved air quality in New York City.

Today’s announcement cites, “City pension funds are on track to have actionable plans to divest from fossil fuel reserve owners by late 2020,” but if the progress over the past year is any indication there is a long way to go before any action moves forward.