The S&P 500 is poised to end 2016 at record highs thanks in large part to the performance of the energy sector. Yes, that same energy sector that activists and protesters claim is weighing down portfolios and responsible for irreversible financial losses.

After finishing in last place for two years in a row, S&P Energy was the best performing index in 2016, rising more than 25 percent. It was the first time the S&P Energy Index had outperformed all other sectors since before the 2008 Financial Crisis. After navigating through an era of low oil prices, over supply and technology disruptions, the industry proved resilient with several analysts now predicting even more gains and a stronger performance next year.

As MarketWatch reports, economists at First Trust Portfolios expect the energy sector to provide a boost to the overall economy in 2017:

“Profits have been held artificially low since mid-2014 due to the energy industry absorbing lower oil prices. Now that oil prices have rebounded, the energy sector should be a tailwind for economy-wide profits, not a headwind.”

And CNBC reports that the energy sector continues to be “among the favorite groups with major Wall Street firms,” adding that energy is expected to account for around 40 percent of S&P 500 revenue growth in 2017, according to JPMorgan.

Yet, divestment proponents would still advocate for the removal of all exposure to energy stocks. In the past, 350.org had argued that divestment makes financial sense because the sector had underperformed the market in recent years. They even ironically criticized California Institute of Technology Prof. Brad Cornell’s study that showed universities foregoing millions in returns if they had divested 20 years ago for “cherry picking” investment timelines, while making their point by cherry picking shorter timelines of their own.

However, we know that endowments and pensions don’t invest with one, five or even 10 year timelines in mind; they invest with the goal of maximizing stable returns for their beneficiaries over the long term. That is why a sudden drop in oil prices or two years of under-performance is not grounds for selling off fossil fuels. On the contrary, an investor would probably want to hold on to those stocks until their prices inevitably rebound, lest he or she would miss out on substantial gains–like the ones we’ve seen this year and will most likely experience in 2017:

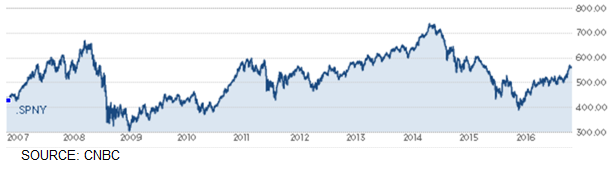

And despite oil prices hitting lows not seen since 2003 earlier this year, a portfolio that was invested in the energy sector five years ago would still have successfully endured the recent volatility and actually achieved slight gains over that timeframe:

And for a longer term investor, gains would have been even more substantial over the past decade:

Activists like Naomi Klein tried to take advantage of the energy sector’s short-lived under-performance in 2015 by saying, “Fossil fuel stocks aren’t performing very well right now. So opponents have just lost their best argument. They won’t lose it for long. So that’s another reason to pound away at it.” All the while, divesting from these stocks at the lows would have meant substantial losses for endowments and pensions.

Additionally, as University of Chicago Prof. Daniel Fischel has noted in the past, the energy sector is an important contributor to any portfolio because it serves as an effective hedge and provides for optimal diversification. Therefore, the benefits of investing in the energy industry far outweigh the sector’s seven percent weighting in the overall market.

It’s clear now more than ever that divestment is a money-losing strategy that has no impact on climate or the environment. Divesting completely contradicts the main goal set by pensions and endowments of maximizing returns for students and beneficiaries, as seen prominently in the sector’s pronounced rebound this year.