This week, another expert on the high costs and ineffectiveness of divestment Todd Kendall, an Executive Vice President atf Compass Lexecon, highlights just why divestment is a dangerous proposition for struggling pension funds around the country and the taxpayers who pay into them.

This week’s stopover included a sit down with The Capitol Pressroom of WCNY Radio to discuss the activist push for Comptroller Tom DiNapoli to divest New York’s state pension fund from fossil fuel companies. When discussing political discourse in the Empire State over the issue of divestment, Kendall was quick to censure politically motivated investments for pension funds as that money ultimately belongs to pensioners. Citing DiNapoli’s fiduciary duty to pensioners, not politicians, Kendall said that it “makes more sense to make political statements through the political process as opposed to pension funds.”

Last week, Kendall, who is a co-author of the recent economic report on the high costs of divestment for New York and Colorado, also spoke with the Heartland Institute regarding the high costs of fossil fuel divestment. He joined Heartland Daily Podcast Host Sterling Burnett to discuss the implication of divestment for pensioners and taxpayers as well as the overall findings from his most recent studies.

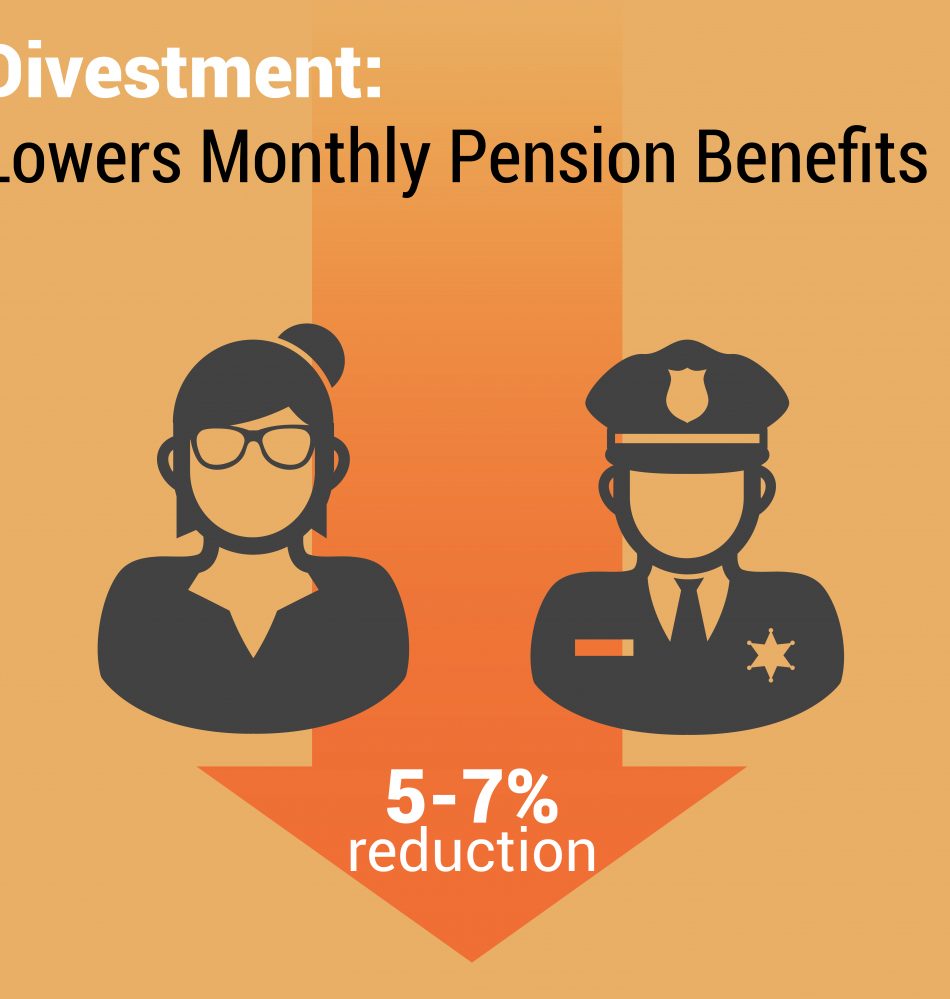

In 2017, Kendall, along with Prof. Daniel R. Fischel and Christopher R. Fiore of Compass Lexecon, released a report that quantified the reduction in risk-adjusted returns that would be caused by divestment at large U.S. public pension funds, including the California Public Employees’ Retirement System (CalPERS), which is the largest public pension fund in the United States, as well as public pension funds of New York City, Chicago, and San Francisco. This year, in response to increased pressure on Colorado and New York politicians to support divestment, Kendall and others released a new report analyzing 50 years of returns from the Colorado Public Employees’ Retirement Association (PERA) and the New York State Common Retirement Fund. The report found, similar to the 2017 findings, that both funds stand to lose millions respectively every year if they were to fully divest from fossil fuels.

Despite such compelling data, activists continue to pursue the futile cause with what Kendall describes as, “not a lot” of success. He held that the movement was ineffective on university campus because of the fiscal burden divestment brings. However, while that burden remains the same with public pension funds, politicians are the differentiating factor.

“In the case of public pension funds, you also have politicians involved who don’t bear the costs of these divestment policies. Those costs go to taxpayers or to pensioners,” said Kendall. Thus, the issue of divestment is not as easily put to bed as it is on a college campus. Though it should be, argued host Sterling Burnett, given the number of underfunded pensions around the country.

Concurring, Kendall cited the 2008 financial crisis as an antecedent along with fiduciary mismanagement and political overpromising. He advised that pensions be focused on the necessary investment moves to remain strong as opposed to divestment, which would result in the opposite.

Divestment isn’t just futile, it’s injurious for pensioners and taxpayers as Kendall’s recent report highlights. He describes the losses as “money you could have had, that you left on the table in order to buy this bumper sticker.” Which, for pension funds that are already significantly underfunded, means further deficits down the line that are felt most by the people who are meant to benefit from these funds.

When Burnett inquires as to the dollars and cents pensioners are losing, to put things in graspable terms for his listeners, Kendall notes that in New York City, the teacher’s retirement fund stands to forgo $27 million in gains for each and every year of divestment and $313 billion dollars total over a 50-year period. The outcome is monolithic, as similar losses span across the country for other pension funds analyzed in previous reports, including the Policemen’s Annuity and Benefit Fund of Chicago and the San Francisco Employees’ Retirement System.

The good news amid these massive losses?

According to Kendall, the future does not have to be as grim and fiscally strained as it sounds. “Divestment is a bad idea [and] there really is an opportunity to avoid these losses now and not suffer them in the future,” said the Compass Lexicon VP.

For more on avoiding the pitfalls of divestment, check out Kendall’s full remarks HERE.